Bengaluru, India, San Jose, California and London, October 27, 2021: Happiest Minds Technologies Limited (NSE:HAPPSTMNDS), a ‘Born Digital. Born Agile’, digital transformation and IT solutions company, today announced its consolidated results today for the second quarter ended September 30, 2021 as approved by its Board of Directors.

Joseph Anantharaju, Executive Vice Chairman, Happiest Minds Technologies said, “We continue our growth momentum with, yet another quarter of stellar growth, driven by a strong demand environment. Given our strong brand recall as a ‘Born Digital . Born Agile’ company and razor-sharp focus on delivering high quality outcomes, we are able to win new logos and increase our wallet share across our existing customers”

Venkatraman N, MD & CFO, Happiest Minds Technologies talking on the financials said, “we have closed yet another good quarter with all-round performance. I am happy to state that during the first half of the year we added on a net basis, 568 happiest minds. We continue to show healthy cash flows and have improved on our capital return ratios prompting us to declare an interim dividend of ₹ 1.75 per equity share”

Financial highlights for

Quarter ended September 30, 2021

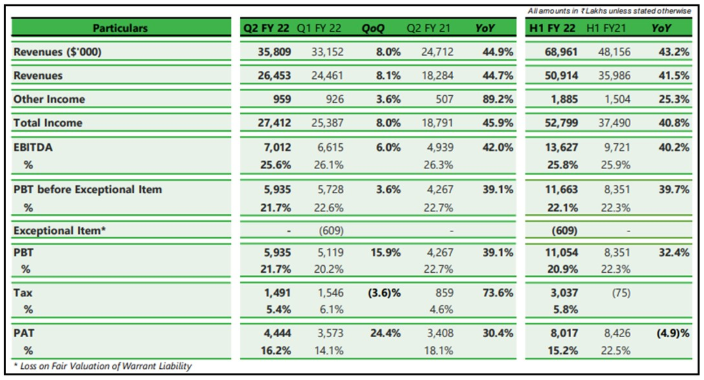

- Operating Revenues in US$ terms stood at $35.8 million (growth of 8.0% q-o-q; 44.9% y-o-y)

- Total Income of ₹ 27,412 lakhs (growth of 8.0% q-o-q; 45.9% y-o-y)

- EBITDA of ₹ 7,012 lakhs, 25.6% of Total Income (growth of 6.0 % q-o-q; 42.0% y-o-y)

- PAT of ₹ 4,444 lakhs (growth of 24.4 % q-o-q; 30.4% y-o-y)

- Free cash flows of ₹ 6,743 lakhs

- EPS (diluted) for the quarter of ₹ 3.06 (growth of 24.9% q-o-q; 26.4% y-o-y)

Half Year ended September 30, 2021

- Operating Revenues in US$ terms stood at $68.9 million (growth of 43.2% y-o-y)

- Total Income of ₹ 52,799 lakhs (growth 40.8% y-o-y)

- EBITDA of ₹ 13,627 lakhs, 25.8% of Total Income (growth of 40.2% y-o-y)

- PAT of ₹ 8,017 lakhs (decline of 4.9% y-o-y)

- Free cash flows of ₹ 13,312 lakhs

- EPS (diluted) for half year ₹ 5.54 (decline of 8.3% y-o-y)

- RoCE & RoE (half year annualized) of 33.8% and 27.5% respectively

Our Business:

Rajiv Shah, Member of the Executive Board, Happiest Minds Technologies said, “Enterprises continue to go full throttle in their digital journeys. Be it to enhance their end-user experience, driving operating efficiencies or recalibrating their business model through their cloud first initiatives. We are fully geared to capture opportunities in this space with our offerings that traverse the length and breadth of our customer’s digital journey”

Clients:

- 186 as of September 30, 2021

- 8 additions in the quarter

Our People – Happiest Minds:

- 3,796 Happiest Minds as of September 30, 2021 (net addition for the quarter 258, half year 568)

- Trailing 12 months attrition of 18.5%

- Utilization of 79.7%, from 82.1% in last quarter

Key Project Wins:

- For a multi-billion-dollar supply chain industry leader, Happiest Minds is helping them build their new SaaS based product

- For a publicly traded global leader in Information Security company, Happiest Minds is building an offshore center to take end-to-end ownership for new features development alongside their Engineering team

- For one of the world’s largest brokers of fine and decorative art, jewelry and collectibles, Happiest Minds was chosen to transform their Financial Services lending processes

- With a Fortune 100 Healthcare provider, Happiest Minds has signed a large multi-year Managed Security Service Provider deal

- For one of the world’s largest global facilities management companies, Happiest Minds was awarded the contract for building digital platforms to enable digital engagement

- For a large US retailer, Happiest Minds is managing its infrastructure services and cloud platform.

- For a Fortune 100 Health insurance company, Happiest Minds is managing their Cloud Security

- For a global supplier of mechanical and electrical drive systems, Happiest Minds is building a digital platform to enable their exponential revenue growth and excellent customer service

Awards:

- Happiest Minds Is ranked among India’s Top 50 Best Workplaces for Women 2021 by Great Place to Work® Institute for the third consecutive year

- Happiest Minds wins two awards at Asiamoney Asia’s Outstanding Companies Poll 2021 o Most Outstanding Company in India under Small / Mid-Caps category o Most Outstanding IPO in India

Announcements:

- The Board of Directors of the Company at their meeting held on October 27, 2021 has declared an interim dividend of ₹ 1.75 per equity share of face value ₹ 2/- for the financial year 2021-22. Record date for the purpose of interim dividend has been fixed on November 10, 2021 and the dividend will be paid on and after November 18, 2021

For further details please refer to the Investors presentation hosted on the company website – – Investors section

About Happiest Minds Technologies:

Happiest Minds Technologies Limited (NSE: HAPPSTMNDS), a Mindful IT Company, enables digital transformation for enterprises and technology providers by delivering seamless customer experiences, business efficiency and actionable insights. We do this by leveraging a spectrum of disruptive technologies such as: artificial intelligence, blockchain, cloud, digital process automation, internet of things, robotics/drones, security, virtual/augmented reality, etc. Positioned as ‘Born Digital . Born Agile’, our capabilities span digital solutions, infrastructure, product engineering and security. We deliver these services across industry sectors such as automotive, BFSI, consumer packaged goods, e-commerce, EduTech, engineering R&D, healthcare, hi-tech, manufacturing, retail and travel/transportation/hospitality.

A Great Place to Work-Certified™ company, Happiest Minds is headquartered in Bangalore, India with operations in the U.S., UK, Canada, Australia and Middle East.

Safe harbor

This release may contain certain forward-looking statements, which involves risks and uncertainties that could cause our future results to differ materially from those in such forward-looking statements. The COVID-19 pandemic could decrease our customers’ technology spend, delaying prospective customers’ purchasing decisions, and impact our ability to provide services; all of which could adversely affect our future revenue, margin, and overall financial performance. Our operations could also be negatively impacted by a range of external factors not within our control including those due to the pandemic. We do not undertake to update any of our forward-looking statements that may be made from time to time by us or on our behalf.

For more information, contact:

Media Contact: [email protected]

Investors Relations: [email protected]