Blockchain technologies are possibly going to become the fundamental building blocks for next-generation applications.

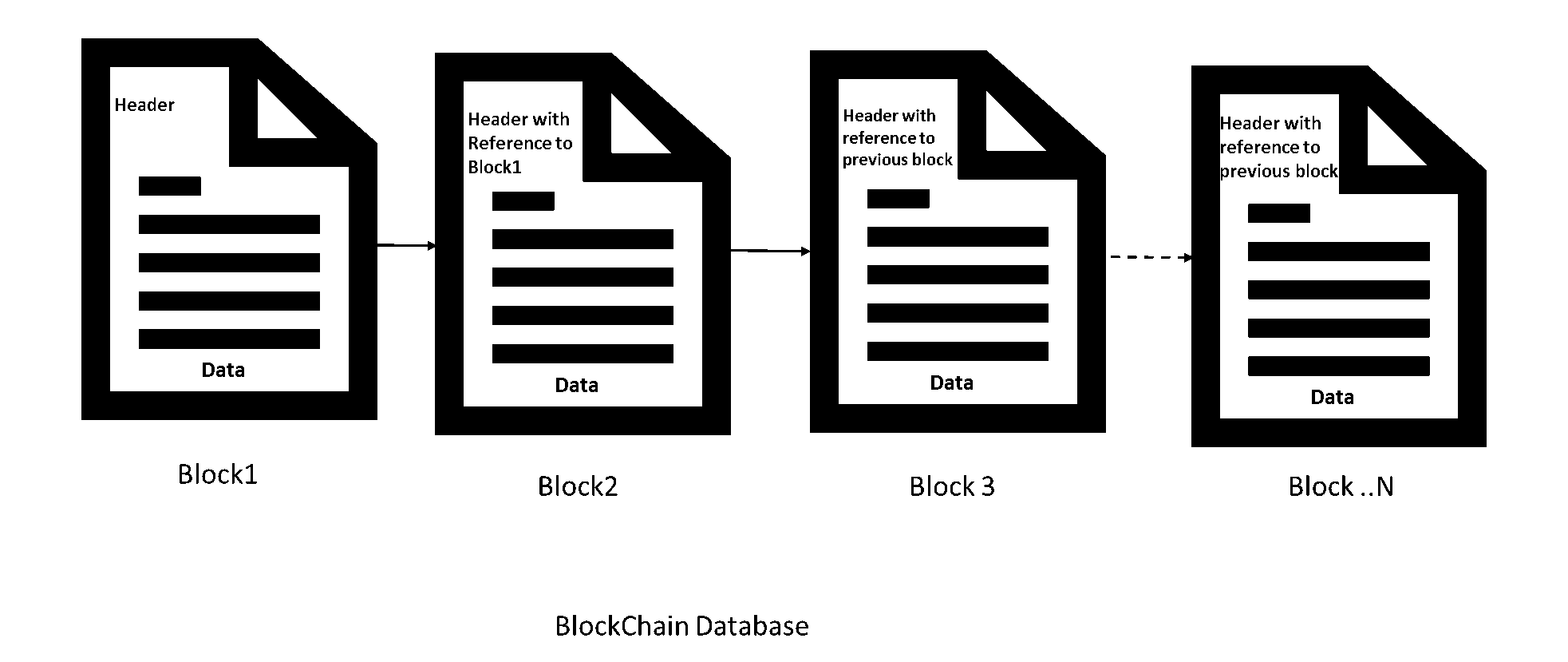

The Blockchain is primarily a chain of data blocks with each block containing a transaction. Each transaction block has in it a header with information on the previous block, anyone who has all the blocks can arrange it and reconstruct the entire Blockchain. The complete Blockchain is available only when all the participants are on the network. These participants should have a unique identity (Private Key) and can participate in any Blockchain network (there are no authorities or regulators to give a single identity). All participants run software that implements the Blockchain protocol.

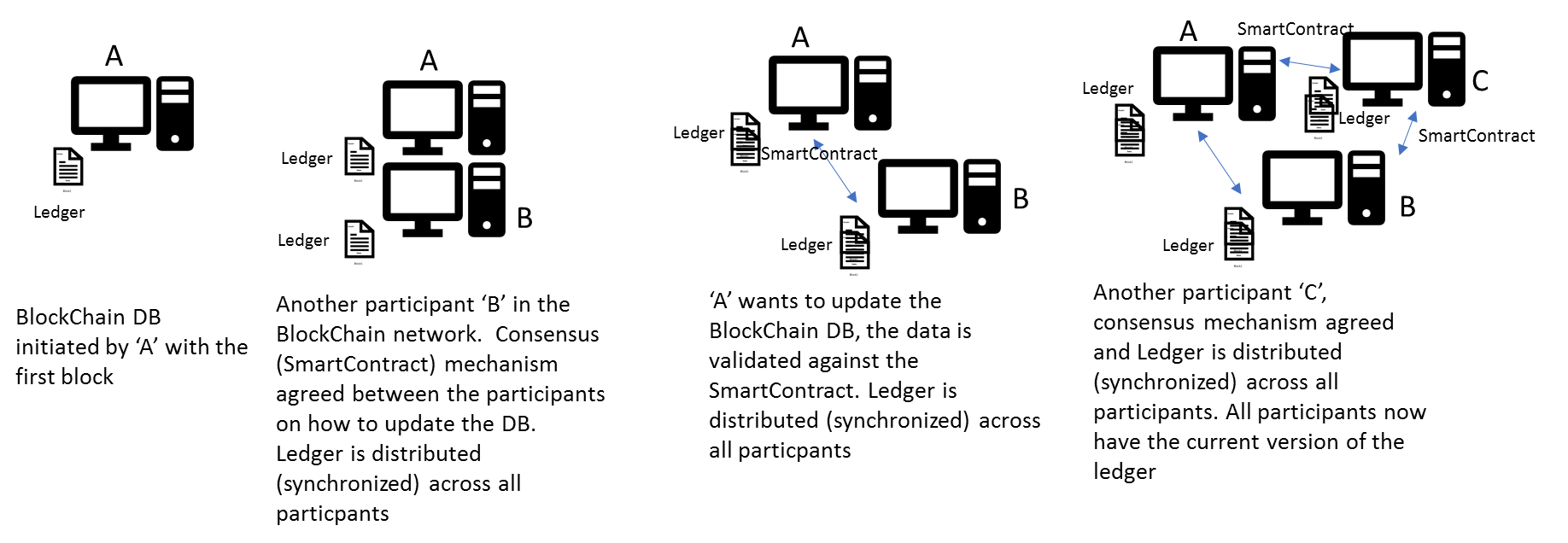

Blockchain as a technology operates on two fundamental concepts, i.e., Distributed Ledger and Smart Contracts. Distributed Ledgers are used to store data while Smart Contracts are the governance mechanism for the Blockchain Network. Bitcoins are generated when processing power is consumed to verify and update a transaction onto the Blockchain database.

Distributed Ledger: – The ledger where all records are maintained, in a Blockchain network, the records are duplicated amongst all participants and hence the name distributed ledger. There is no central location where records are stored as all nodes have a copy. There are no central authorities, or regulatory that regulates who can be part of the network or who can update the Blockchain. The ledger is maintained by all participating nodes using a consensus principle.

Smart Contracts: – The blocks in a Blockchain are written only on consensus, and one way of achieving the agreement is through smart contract. A Smart contract is a set of computer instruction (code) that all the participants must agree. Whenever a block is written into the Blockchain, the code validates the data against the agreement, and on successful validation of data it is converted into a block and written into the Blockchain. All the participants in the network then update their Blockchain. The code follows a very simple rule ‘if this then does that.’ Smart contracts are pre-written computer code, they are stored and replicated across all the participants in the Blockchain network, and they are executed on all the nodes when a block must be written into the data. The result of executing the smart contract is usually writing of the block into the Blockchain. When a block is written into the ledger, the participant that helped with validating the block and writing the block into the ledger is rewarded with a Bitcoin.

Definition from BlockChainTechnologies.com explains that, “Smart Contract (also called self-executing contracts, Blockchain contracts, or digital contracts) are simply computer programs that act as agreements where the terms of the agreement can be preprogrammed with the ability to self-execute and self-enforce itself. The main goal of a smart contract is to enable two anonymous parties to trade and do business with each other, usually over the internet, without the need for a middleman. The origin and history of smart contracts are much older than bitcoin and dates to the 1990’s. The term ‘smart contract’ was first coined in 1993 by one of bitcoin’s alleged creators, Nick Szabo, and referred to self-automated computer programs that can carry out the terms of any contract.”

Bitcoins: – Any participant on the Blockchain network who provide processing power to validate and record transactions into the Blockchain is a potential ‘miner’ and as a reward gets bitcoins. The bitcoins are only virtual; there are no physical or digital coins. The bitcoins are stored in a digital wallet, and the owner has the key to the digital wallet.

Every four years the number of bitcoins created are halved and currently has a higher limit of 21Million bitcoins. There are no clear reasons why a 21Million restriction (the currency is infinitely divisible, and only an upper limit is set), but the closest explanation is that initially, 50 bitcoins would was rewarded to the first participant who writes into the Blockchain and subsequently halved every four years. i.e., 50 bitcoins in the first four years, 25 coins in the second four years and so on..

- Total Blocks in an hour @ 1 block every 10 minutes = 6 Blocks

- Total Blocks in a day = 6Blocks * 24 = 144 Blocks

- Total Blocks in a year = 365 * 144 = 52,560 Blocks

- Total Blocks in four years = 210,240 Blocks

- Total Blocks = 210240 * (Total Number of Bitcoins every four years)

- Since bitcoins reduces by half every four years – 50+25+12.5+6.25+… = 50/(1-0.5) = 100 (by geometric series)

- Total Bitcoins that would be possible = 210240 * (100) = Almost 21Million

From the above logic, it is not clear why the assumption on only six transactions a minute, 50 bitcoins for a block being written and bitcoins being halved every four years were made, and, if any of these assumptions, will cause a Y2K kind of issue.

However, Bitcoin is a distributed computing innovation and the name of the protocol. Bitcoin is the network. Bitcoin currency is the first application of Blockchain.

Please note: This blog is part of a series of Blockchain articles. Through these articles we explore about Blockchain – The technology, the hype, the opportunity, the do’s and the don’ts.

is Vice President and Chief Information Officer, has over 23 years of experience in diverse technology and management roles. Sajith has varied experience in the IT field, he has handled multiple roles from supporting IT to developing applications to building large teams and to delivering IT initiatives for large enterprise accounts.

Prior to joining Happiest Minds, Sajith worked with MindTree on multiple roles and initiatives. Sajith has also worked with Wipro as an application developer and as a support engineer in the infrastructure and networking group.