What is Open Banking?

The banking industry is changing quickly due to shifting consumer expectations and behaviours, increased regulatory scrutiny, and new technology that enables a broader range of goods and services. Financial institutions must control costs, stay compliant, and uphold security and confidence in this dynamic climate. Governments are increasingly getting involved to boost innovation and competition in the banking sector. A new global banking environment called Open banking is developing because of these forces. Open banking refers to the process of granting access to customer banking data, such as transactions and payment history, to outside financial service providers with the use of application programming Interfaces (APIs).

This blooming idea encourages networking and interoperability between banking information and service providers, improving user experience and connecting all user accounts.

When using open banking, what kind of financial information are you disclosing?

For example: The list of things shared with outside providers as part of open banking.

Account information

- Name of the account holder: XXXX XXX

- Account open date: November 13, 2020

- Account type: Savings, Checking

- Currency: Euro (€), American Dollar ($)

- Transaction details: Amounts, Merchants, etc.

Product and services data

Sharing is a two-way exchange. By giving access to your bank account data we listed above, banks and other providers can, in turn, share financial data and information regarding their products and services.

Once you understand what the bank has to offer, with digital banking you could browse the bank’s website and make that decision for yourself.

Open banking goes one step further by automatically producing recommendations and actively customizing its service to your profile. Additionally, it enables service providers to continually create new features that vastly improve your banking experience.

In a nutshell, “open banking” refers to how banks permit licensed financial firms to access, utilize, and share your banking information. No action is taken without your permission. A bank will need your permission before granting access to your data, whether it comes from checking a box on a terms-of-service pop-up or receiving an official email telling you about it.

These licensed providers will collect the information they require, analyze it, and begin creating a precise consumer profile after receiving consent.

Personal finance is now conducted digitally, and consumers must be able to access, manage, and engage with their accounts wherever they are and at any time. This is where open banking comes in to elevate the user experience.

Third-party providers who have access to your account information can make their suggested services more pertinent by doing so.

Other features include

- real-time updates

- personalized investment advice

- price comparison tools

- savings notifications

- budgeting recommendations

- pricing comparison features

Since you now have a partner in the background constantly analyzing data and offering a better course of action for your financial well-being, open banking transforms you from being reactive to proactive.

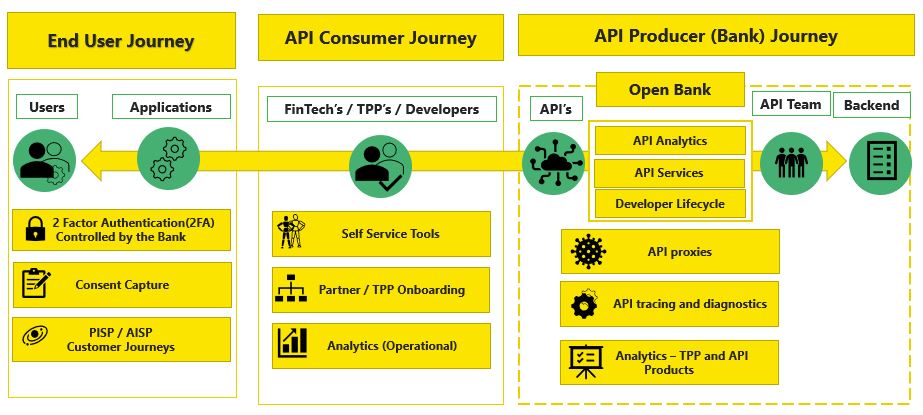

How can Banks and Financial services adopt Open Banking in their framework?

Takeaways from Open Banking.

Below are key takeaways from Open banking, that can help bankers to focus on embedded banking as well as financial services opportunities.

- API’s first approach compared to vertical integration that served banks so well in the past.

- The possibility of new distribution channels that can be integrated into a larger ecosystem

- Evolution of standards that instills confidence in stakeholders which provides additional momentum to the transition. Ex: Open Banking Implementation Entity (OBIE) in the United Kingdom.

Embracing Open Banking

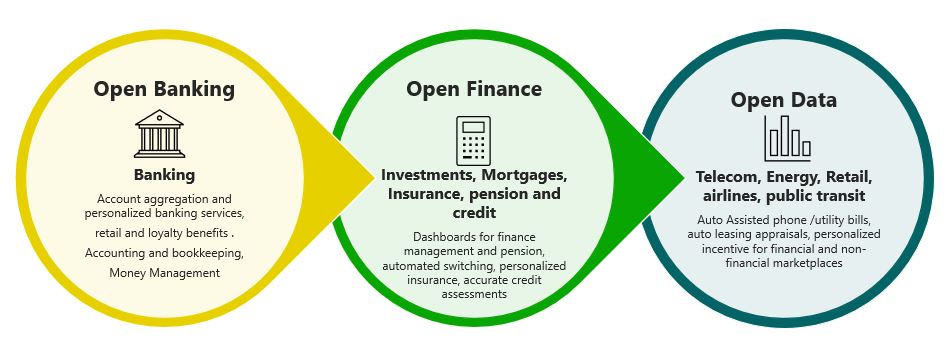

Open banking is changing the way people use banking services in the modern world and has already shown a positive impact on competition in payment services and the banking sector generally, enhanced consumer protection and supported the creation of new payment solutions.

Europe prides itself on being the cradle of the open banking revolution, with the EU’s Payment Services Directive1 (PSD2) being one of the first regulatory initiatives to open bank-held account data.

The potential benefits of open banking are substantial: improved customer experience, new revenue streams, and a sustainable service model for the traditionally underserved. This can be achieved by banks and financial services companies by focusing on the cloud, low-no code, and external APIs to quickly compose customized core applications that make the offerings of financial services purchase and service processes fast for customers. In the long run, if the traditional players don’t act now, new-age banks will gain a considerable market share from the former due to fast and simple digital experiences delivered in weeks instead of years.

Happiest Minds Solution

We at Happiest Minds, with 20+ years of BFS experience, are working on multiple API-first solution offerings leveraging our digital innovations in low-code partner ecosystems (Appian, ServiceNow and OutSystems), which co-exist with core banking and financial services products. Get in touch with a Happiest Minds BFS specialist today to understand banking and financial services technologies solutions and offerings.

is the banking lead for Digital Business Services for BFSI at Happiest Minds. She has two decades of experience in the banking technology industry, with a focus on core banking solutions and large-scale digital transformation in banking and payments applications. At Happiest Minds, Padmini is primarily responsible for business outcomes and is a subject matter expert in banking.