What exactly is Embedded Insurance?

Insurance has been one industry where the traditional sales channel contributes to the majority of the revenue. Postpandemic, there has been a noticeable change in customer behavior and preference along with increased competition. This has paved the way for the growth of newer channels for policy sales. One of the innovative approaches to customer engagement and distribution has been through embedded channels / embedded insurance.

Embedded insurance has been in existence for a long time but has never been called such. One of the most common examples would be warranty insurance. When purchasing a vehicle in some countries, an extended warranty is offered as an optional benefit. Another example, is an Electronics and software company that has a partnership with an insurance company in a specific country to offer warranty products. Embedded insurance has the potential to become a trillion-dollar market, according to industry analysts.

Embedded insurance is concerned with combining insurance and non-insurance products to improve the customer experience with the other product. The right product in the right place makes the difference. For instance, selling insurance together with vacation tickets. The sales of insurance products through embedded channels are faster and provide digital experience.

Key Drivers for Embedded Insurance?

Embedded insurances are motivated by changing client demands, which are prompted by a tech-savvy user. As the number of clients adjusting to new technologies grows across all industries. The need for a point-based and tailored offering has grown. As online goods sales evolve, so do sales of integrated insurance products.

To arrive at the right product for the right market, requires understanding the digital touchpoints, which plays the key in understanding customer behavior. Technology, data, and AI are the key drivers in the value chain. Which helps in the right position of the product, personalization, increase customer satisfaction and reduce operational cost.

How can insurance carriers adopt embedded insurance?

Takeaways from Open Banking

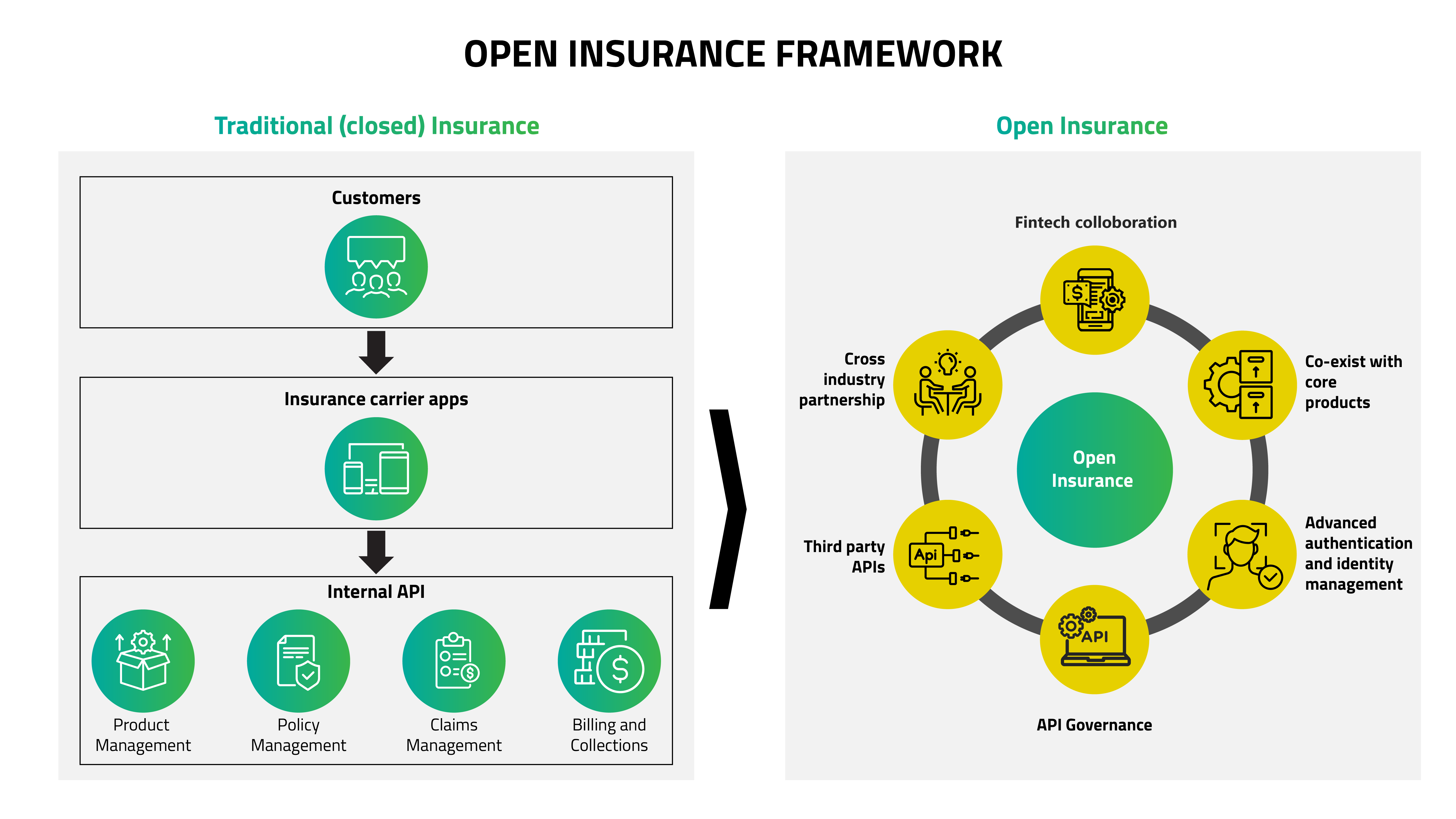

Open Banking is a global movement that transformed how financial institutions deal with data. The Open Banking ecosystem has enabled customers and SMEs to share their current account information securely with thirdparty providers, who use that data to tailor their apps and services. Below are key takeaways from Open banking to Insurance, that can help insurers focus on the embedded insurance opportunities.

- API’s first approach compared to vertical integration that served insurers so well in the past.

- The possibility of new distribution channels that can be integrated into a larger ecosystem

- Evolution of standards that instills confidence in stakeholders which provides additional momentum to the transition. Ex: Open Banking Implementation Entity (OBIE) in the United Kingdom.

Embrace Open Insurance

API’s first approach leads to Open insurance. EIOPA describes Open Insurance as “covering, accessing and sharing insurance-related personal and non-personal data usually via APIs”. When needed, customers authorize their service providers to make their data accessible in return for more personalized services and better experiences.

Embracing the open insurance approach, renowned PNC products provide excellent integration capabilities. For example the REST API support is not just for the Guidewire cloud versions but starts from self-managed on-premises versions too. Insurers with Guidewire as their core system of records should start looking at opportunities leveraging its robust API capabilities which can open embedded insurance opportunities.

Recently there is a surge in Insurtech companies focusing on cloud, low-no code, and external APIs to quickly compose customized core applications that make the insurance purchase and service process fast for customers. In the long run, if the traditional insurers don’t act now, new-age Insurtech companies will gain a considerable market share from the former due to fast and simple digital experiences delivered in weeks instead of years.

Happiest Minds Solution

We at Happiest Minds, with 20+ years of insurance experience, are working on multiple APIfirst solution offerings leveraging our InsurTech low code partner ecosystem (Appian, ServiceNow and OutSystems) which co-exist with core insurance products. Get in touch with a Happiest Minds Insurance specialist today to understand insurance technologies solutions and offerings.

We learned, APIs Are Critical to Open insurance and Digital Business Services. But how hard is it to achieve it? Stay tuned for more updates on this space.

Krishna Kumar Ganesan (KK) is the BFSI – Insurance lead for Digital Business Services at Happiest Minds. He has ~ two decades of experience in the Insurance Tech industry and has proven expertise in Presales and Solutioning, having implemented product and solutions. At Happiest Minds, KK is primarily responsible for business outcomes and is a subject matter expert with Insurance.

Anand Kumar Loganathan (Anand) is the Senior Architect, Guidewire for Digital Business Services at Happiest Minds. He has an overall experience of 13+ years in the BFSI industry. He specializes in largescale business transformation of Insurance applications, involving full suite implementation and Major upgrades across APAC, Americas & Europe.