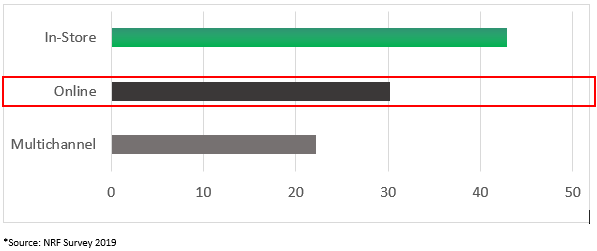

Areas where Retailers noticed the most significant increase in fraud occurring

Prevention of Ecommerce Fraud must be your utmost priority in 2020. Know why?

With E-commerce sales estimated to reach $630 billion (or more) in 2020, an estimation of $16 billion will be lost because of fraud.

From 2018 to 2019, E-commerce spending increased by 57% — the third time in the U.S. history that the money spent shopping online exceeded the amount of money spent in brick-and-mortar stores.

A study by the Crowe UK and Centre for Counter Fraud Studies (CCFS) shows that 21% of consumers are afraid their credit card data to be stolen and 19% believe their confidential data may be misused. 54% of shoppers said they faced fraudulent or suspicious actions on the Internet.

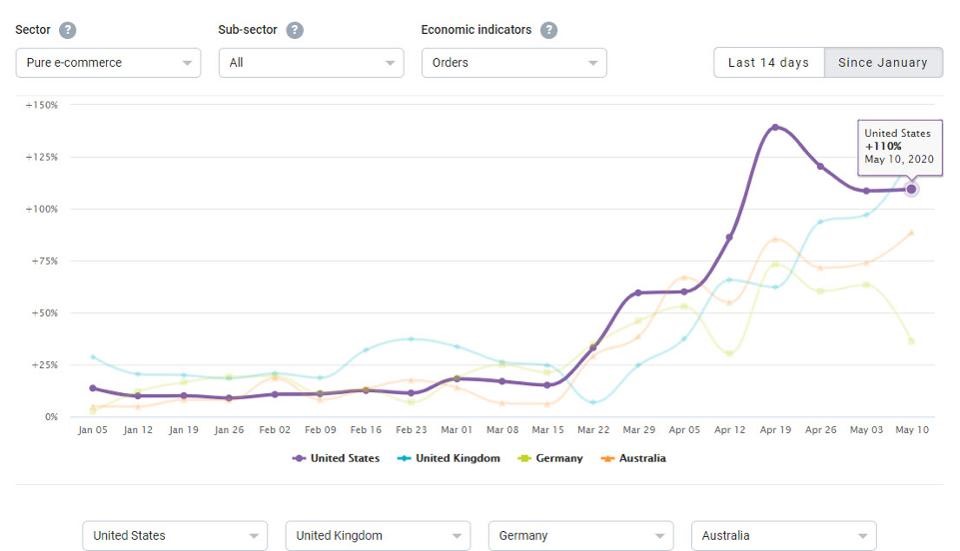

Due to COVID-19 quarantine, people are making more purchases online. In total, there has been a 110% year-over-year increase pure e-commerce orders in the U.S. alone, according to the COVID-19 Commerce Insight dashboard.

As the E-commerce fraud trend rises and E-commerce fraud scenarios and malware become more subtle and harder to detect, protection has never been this important.

E-commerce fraud threats:

Business e-mail compromise: This type of scam aims at businesses working with overseas suppliers and partners who continually make wire transfer payments. The fraud starts by seeking out legitimate business e-mail accounts and compromising them through social engineering or specialized software that allows intrusion to make illegal money transfers.

Data breach: This happens at personal or enterprise levels and implies the leaking of sensitive, confidential, or protected information. The information is usually stolen or copied from a database.

Denial of service: Disruption of any user session entering into a system or network caused by fraudulent activity.

E-mail account compromise: this is the alternative version of business e-mail compromise that aims at the general public as well as professional people working in financial and lending enterprises, real estate companies, and judicial firms. Criminals use the compromised e-mail account to transfer costs to a fraudulent location.

Malware/scareware: a kind of ill-natured software that is developed to intrude into computers and computer systems to damage or disable them.

Phishing/spoofing: both terms refer to a similar notion and imply forging e-mails in a way that makes them appear very close to those sent by legitimate businesses.

Ransomware: This is a type of malware targets the technical and human weak points in enterprises to disable valuable data or systems. Once the victim finds out, they cannot gain access to the valuable data again. They receive a demand from the criminal to pay a ransom to regain access.

Types of E-commerce fraud:

- True (classic) fraud:Stealing or purchasing of a victim’s credit card details on the Dark Web. When a criminal makes an unauthorized purchase, a customer can dispute the purchase. The bank then closes the current account and issues a new credit card number and sends a new credit card to the fraudster. This is usually a method for newbie fraudsters.

- Friendly Fraud – The customer keeps the purchased item, but gets a refund, because they falsely claim that the product does not live up to expectations or because they claim payment was made with a stolen card.

- Clean Fraud – When a fraudster obtains and uses another person’s identifying personal information to commit fraudulent actions, for instance, an online purchase.

- Phishing – This takes place when a hacker pretends to be a known contact and requests personal data or tries to get you to install malware, which can then retrieve the data itself.

- Card validity testing – In this case, a criminal tests different card details to reveal if the credentials are valid and then uses them at another website to make unauthorized charges. If a website declines the card because of an invalid expiration date, they will know this is the number they have to permutate using bots.

- Re-shipping – The fraudster “hires” an unknowing third-party to re-ship products purchased with stolen card information. The fraudster never pays the third-party as promised and, the third-party ends up being an accomplice in the crime

- Triangulation fraud – Triangulation refers to the case in which the fraudster creates a fake online storefront, selling goods at cheap prices. It involves a fraudster, a legitimate shopper, and an E-commerce business. This storefront has the sole purpose of gathering credit card data.

- Chargeback fraud – Refers to instances where a customer purchases something from your store with a financial account they own, then proceeds to request a chargeback from their bank after receiving the goods they purchased. They might also contact your business and claim the product they ordered was never delivered.

Happiest Minds Offerings:

- Consulting & Advisory Services – Assessment of fraud and loss across the various eCommerce channels. Study of systems, processes, trends, historical data to identify areas of concern

- Recommend trends, patterns, interventions of loss prevention

- Benchmarking against industry metrics. Comparison of customer benchmark vs industry

- Analytics based solutions for cyber threats and security for real-time alerts, notifications

- Advanced Dashboard Reports based on trends, pattern detection. Identify key KPI’s and monitoring and measurement of identified KPI’s

- Machine Learning models, recommendations based on trends

Appendix

Sources:

is a Business Analyst/Functional consultant in Digital Business services with close to 10 years in the industry for technologies and products. He has been doing business analysis, process design, requirements elicitation, process discovery across multiple domains namely – retail, ecommerce, BFSI, manufacturing, telecom, etc. throughout his career and also responsible for business development and pre-sales activities. He has been associated with Happiest Minds for almost 4.5 years and is involved for RFP/RFI responses for providing comprehensive solution offerings and building value propositions.