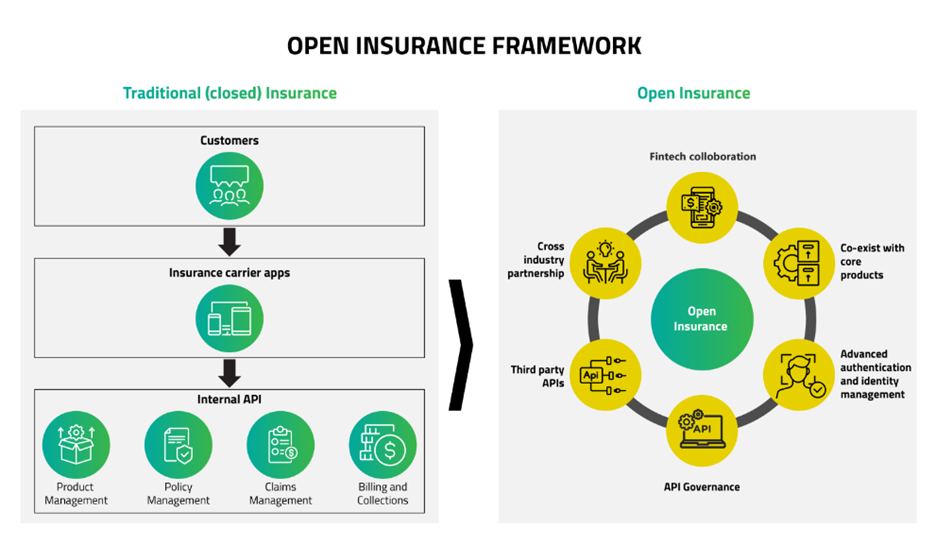

In the fast-paced world of insurance, a new buzzword is making waves – Open Insurance. This innovative approach is reshaping the traditional insurance model, bringing about increased transparency, collaboration, and personalized services for policyholders.

What is Open Insurance

Open Insurance is a paradigm shift from the conventional closed-loop insurance systems. It leverages digital platforms and technology to foster collaboration among insurers, third-party service providers, and customers. This open ecosystem allows for seamless data sharing and connectivity, transforming the insurance experience into a more dynamic and responsive one.

Generative AI in Open Insurance

Generative AI stands as a transformative force within the realm of open insurance, reshaping traditional practices and propelling the industry into a new era of efficiency and innovation. In open insurance, where collaboration and data-sharing thrive, generative AI plays a pivotal role in enhancing risk assessment, fraud detection, and overall operational processes. By leveraging advanced machine learning algorithms, generative AI analyzes vast datasets to discern intricate patterns and correlations, allowing insurers to make more informed decisions and offer dynamic, personalized coverage options. Its ability to automate underwriting processes and swiftly detect anomalies contributes to a streamlined and agile insurance ecosystem. The integration of generative AI in open insurance not only improves risk management but also positions insurers to adapt rapidly to changing market dynamics, marking a significant leap forward in the evolution of the insurance industry.

Key Features of Open Insurance

Data Accessibility: Open Insurance breaks down silos by enabling the secure sharing of data between different stakeholders. This allows insurers to have a more comprehensive view of the policyholder’s risk profile, leading to more accurate underwriting and personalized coverage.

Interconnected Ecosystems: Through Application Programming Interfaces (APIs), insurers can integrate with various platforms, such as IoT devices, health apps, and smart home systems. This interconnectedness enhances risk assessment, claims processing, and overall customer engagement.

Customer Empowerment: Policyholders gain greater control over their insurance experience. They can manage policies, track claims, and access a broader range of services through user-friendly interfaces. Open Insurance empowers customers by putting them at the center of their insurance journey.

Benefits of Open Insurance

Innovation and Agility: Open Insurance fosters innovation by allowing insurers to collaborate with Insurtech startups and other industry players. This leads to the rapid development of new products, services, and business models, keeping the industry agile in a fast-paced digital era.

Enhanced Customer Experience: The customer-centric nature of Open Insurance results in improved service quality. Policyholders experience faster claims processing, personalized offerings, and a more responsive interaction with their insurers.

Risk Mitigation: With access to a broader set of data, insurers can better understand and mitigate risks. This not only benefits the insurance companies in terms of profitability but also ensures fairer premiums for customers based on their actual risk exposure.

Challenges and Considerations

While Open Insurance brings numerous advantages, it’s essential to address potential challenges such as data privacy concerns, cybersecurity risks, and regulatory compliance. Striking a balance between innovation and risk management is crucial to the success of this transformative model.

The Future of Insurance

Open Insurance represents the future of the industry, fostering a collaborative and customer-centric environment. As insurers continue to embrace this model, we can expect further advancements, improved efficiency, and a more inclusive insurance landscape.

In conclusion, Open Insurance is not merely a technological evolution but a cultural shift within the insurance sector. Embracing openness and collaboration is key to staying relevant and resilient in an industry that is rapidly adapting to the digital age. As we navigate this transformative journey, the ultimate winners are the policyholders who stand to benefit from a more responsive, innovative, and customer-friendly insurance experience.

Happiest Minds solution:

At Happiest minds, our commitment lies in revolutionizing the insurance landscape through cutting-edge solutions that drive efficiency and customer satisfaction. Happiest Minds, a leading digital transformation and IT consulting company, offers a range of innovative Insurance solutions such as Straight through claim processing, Generative AI fraud claim detection, Policy chatbot, Intelligent test engine, embedded insurance. These solutions are designed to enhance efficiency, customer experience, and profitability of insurance industries.

Get in touch with a Happiest Minds BFSI specialist today to understand Insurance technologies solutions and offerings.

has over 8 years of expertise in the insurance industry and business analysis. Competent in conducting stakeholder management, feasibility studies, gap analyses, and requirements gathering. Competent in both Agile and Waterfall methods, with a track record of successfully managing projects and putting solutions into action on budget and on schedule.