A Low-Code Application Platform (LCAP) is a software development environment that enables the creation of web or mobile applications with reduced complexity and faster development. It provides a drag-and-drop interface, pre-built templates and modules, and visual modelling tools that allow users to design, develop, and deploy applications quickly and efficiently. LCAPs use a variety of programming languages, including JavaScript, HTML, and CSS, as well as proprietary languages, libraries, and frameworks, to simplify application development. They also provide various integration options, including Application Programming Interfaces (APIs), third-party services, and cloud-based platforms, making connecting applications across different systems and data sources easier.

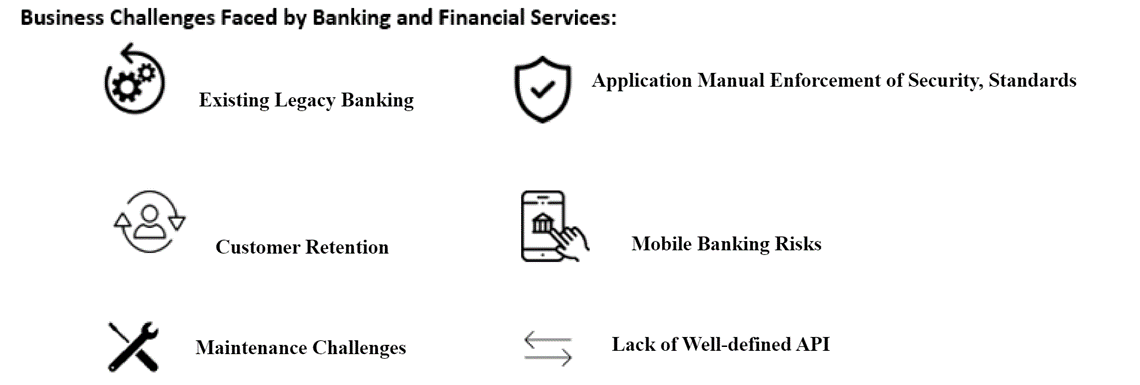

Customers are now at the forefront of their banking needs in this new banking era. Consumers now have more sophisticated digital skills and are particular about what they need and want. Banking services are, therefore, moving towards a customer-centric model. As a result, the seamless client experience is now the focal point of all banking services. The financial services sector is being forced to rethink the end-to-end service delivery architecture due to regulations requiring operational resilience, digitization for economies, and competitive pressures from high-tech companies.

But where will the required capacity and resources to tackle these challenges come from?

A high-performance, low-code development platform may release the necessary capacity, which is also well-suited to optimize the development, construction, and launch of digital financial services. Organizations are increasingly relying on low-code development technologies to meet their customers’ growing demands – highly customized automation workflows and speedy application delivery.

Use Cases of Low-Code Application Platforms (LCAP) in the BFSI Sector include:

- Online Banking: LCAPs can be used to develop online banking platforms, allowing customers to access their accounts anytime, anywhere, and on any device.

- Compliance Reporting: LCAPs can help financial institutions create and manage compliance reporting processes, ensuring that they meet regulatory requirements.

- Customer Support Applications: LCAPs can be used to build customer support applications, enabling banks to provide better service to their customers and address issues more efficiently.

- Mobile Apps for Banking: LCAPs can be used to develop mobile apps for banking, allowing customers to manage their accounts, make transactions, and access other services on their smartphones.

- Risk Management and Compliance: LCAPs can be used to develop applications for risk management and compliance, helping banks identify and mitigate potential risks and ensure that they adhere to regulatory requirements.

- End-to-end Digital Financial Services Delivery: LCAPs can be used to rapidly build and deploy digital financial services, improving the overall customer experience and streamlining service delivery.

These use cases demonstrate the versatility and value of LCAPs in the BFSI sector, enabling rapid application development and deployment to meet the evolving needs of the industry.

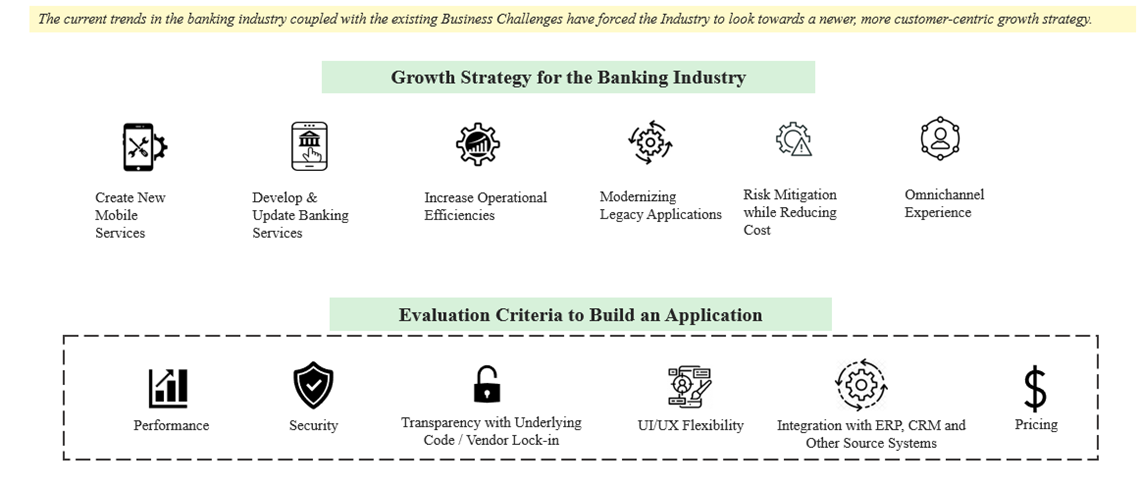

Growth Strategy & Future of Application Development in BFSI

The recent developments in customer expectations and the industry’s future strategy have charted the way for faster, more robust, more agile, and more secure applications. Fast-changing business needs mean rapid application development and deployment.

At Happiest Minds Technologies, we are committed to enabling the success of our clients by providing innovative and efficient LCAP solutions. Our team of experts has a proven track record of successfully delivering LCAP-based applications that meet client requirements and exceed client expectations.

Leveraging our expertise in LCAP technology, we have helped numerous clients achieve the following.

- Reduced internal workflow processing time due to easier integrations, leading to increased efficiency and productivity.

- Achieved up to 60% reduction in application maintenance cost.

- Experienced a 65% – 90% reduction in development time.

- With the microservice architecture offering, attained ease of introducing technology without affecting normal business operations.

- Increased CSAT by almost 68%.

In summary, low-code technology can significantly enhance the customer experience in the banking sector by enabling faster, more customized, and user-friendly application development. By facilitating hyper-automation and improved risk management, it has truly redefined BFSI in this digital era.

We have the experience to create and support large-scale low-code platforms with real-time business insights to help you reach your exponential business goals.

If you’d like to discuss how your banking business could uncover new efficiencies across the value chain with Low-Code Technology, reach out to us!

is a dedicated Business Analyst at Happiest Minds, excelling in identifying and implementing RPA solutions for organizations. He is a team player with good problem-solving ability and a keen eye for analyzing business processes. Holding a Master’s in MBA (Operations) and a bachelor’s in mechanical engineering, he is a valuable asset to any organization seeking to streamline operations and enhance efficiency.