In the ever-evolving landscape of auto insurance, traditional models often rely on generalized factors that may not accurately reflect an individual’s driving behavior. However, a paradigm shift is underway with the advent of Usage-Based Insurance (UBI). This innovative approach harnesses real-time data on driving habits to tailor insurance coverage, offering a more personalized and equitable pricing structure.

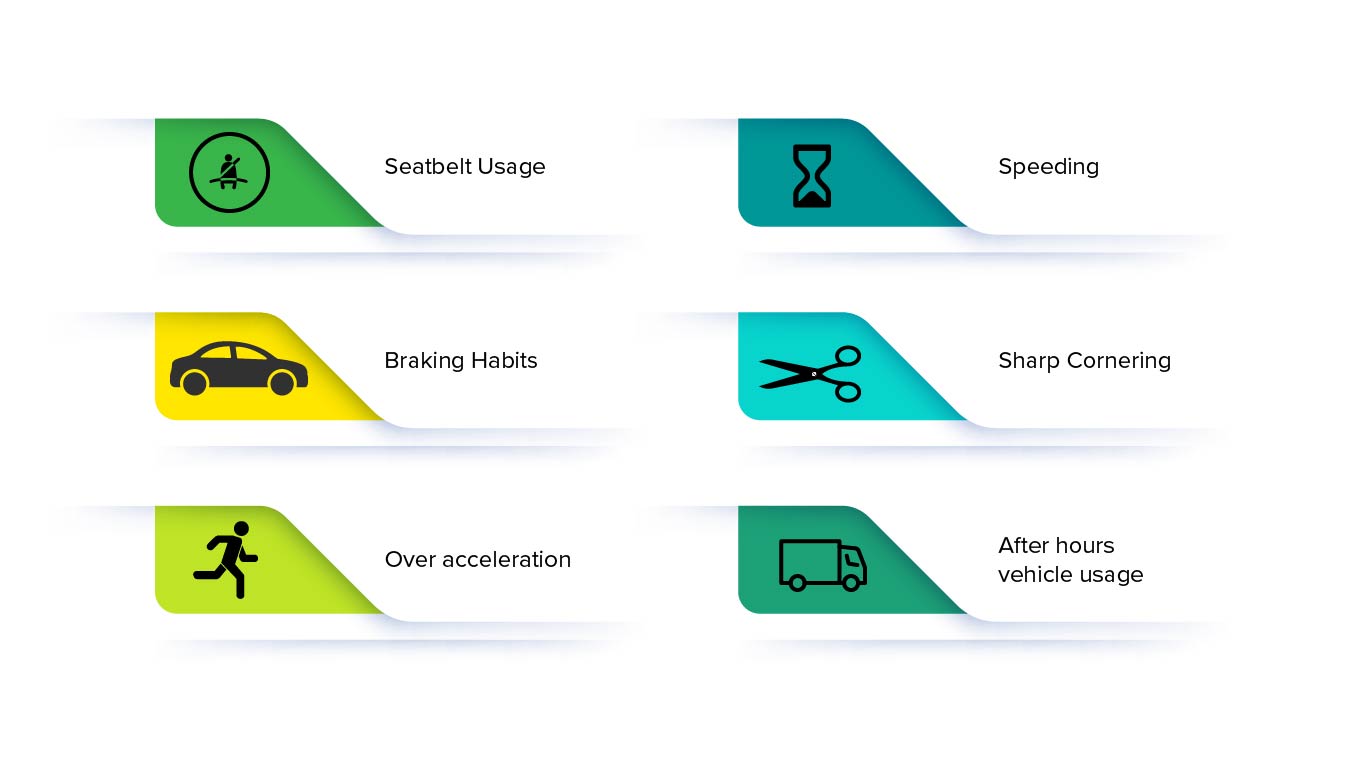

Kinematics, a branch of physics dealing with the motion of objects, finds a natural application in the realm of UBI. By analyzing factors such as speed, acceleration, braking patterns, and even the curvature of turns, insurers can gain a deeper understanding of how a vehicle is operated. This granular data transcends conventional proxies like age or credit history, providing a nuanced assessment of risk.

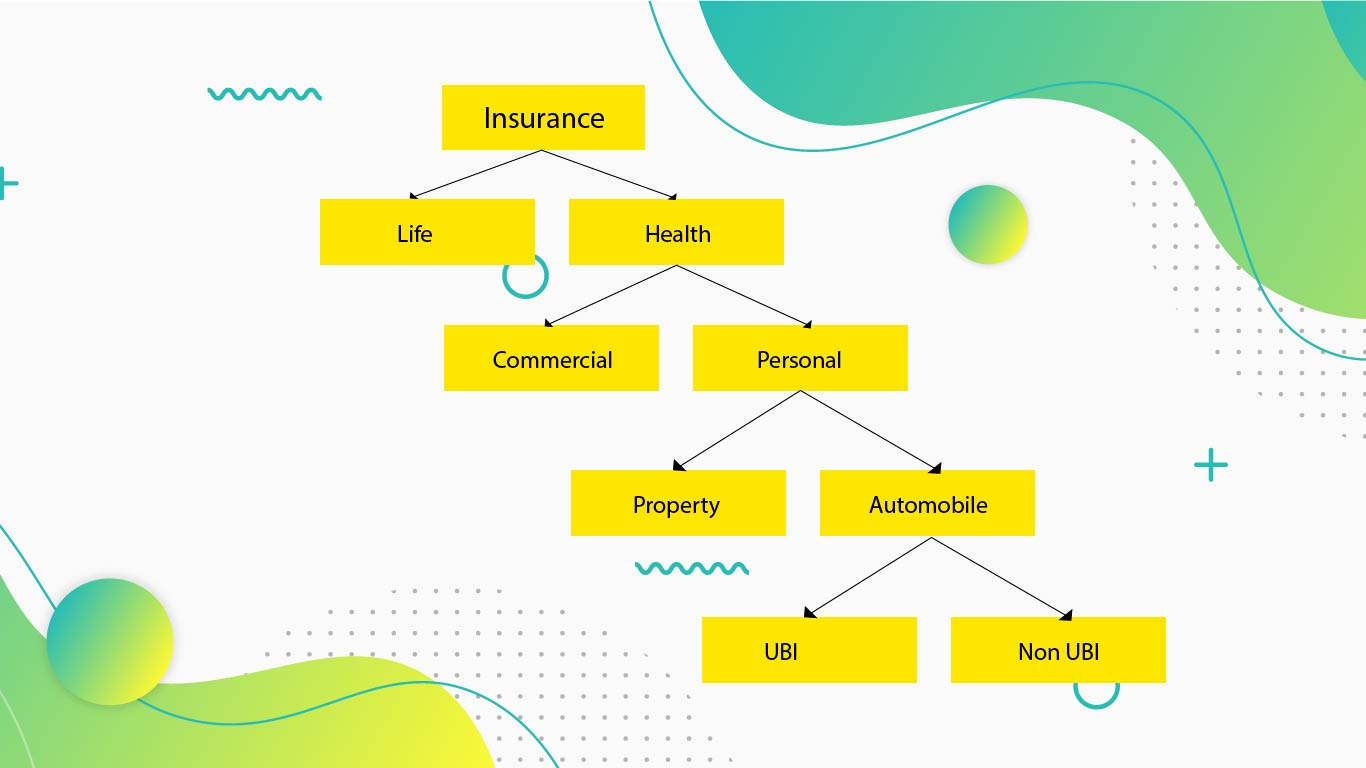

Classification of Insurance

Risk & Safety Trends

Challenges

Traditionally auto insurance relies on conventional demographic factors for risk assessment, which lacks the granularity needed for precise evaluation. However, consumers exhibit hesitancy towards adopting Usage-Based Insurance (UBI) due to the perceived inconvenience associated with installing monitoring devices. The complexity introduced by UBI transactions, in comparison to traditional insurance applications, presents a barrier to seamless adoption. These factors collectively impede the widespread acceptance and implementation of UBI in the insurance market.

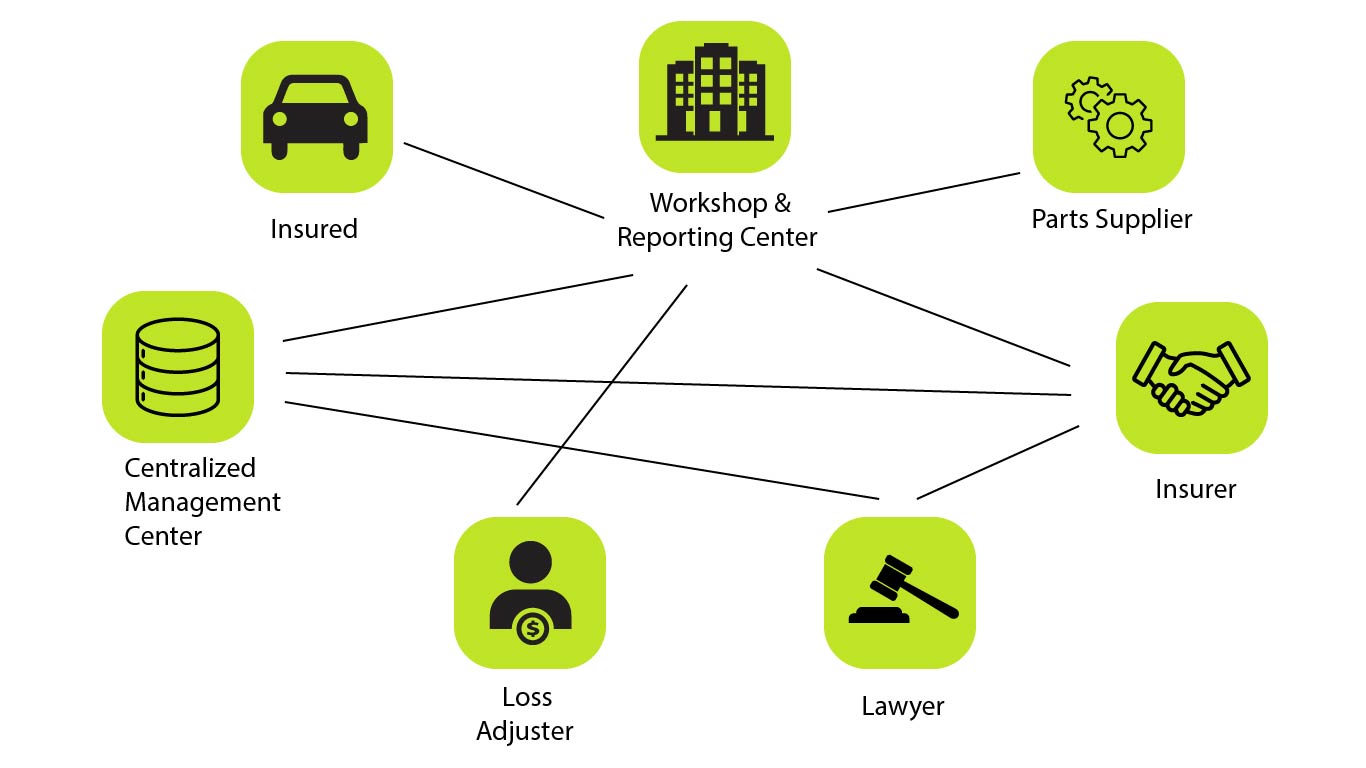

Impact on the Insurance Industry

According to findings from the McKinsey report on Insurtech, the predominant areas of innovation among industry players are centered around Big Data and Machine Learning, representing 20% of the total, followed closely by the adoption of Usage-Based Insurance (UBI) at 13%. The TransUnion survey on usage-based insurance (UBI) highlights that while UBI could reduce car insurance rates for safe drivers, this isn’t always the case. Only 48% saw lower rates, while 30% saw no change. Some insurers may increase rates for poor driving, affecting 18% of respondents. Nevertheless, 64% are content with UBI, and a similar percentage still use telematics programs.

Maximizing Insurance Benefits with UBI and Information Technology Service Providers:

- Personalized Solutions: Data analytics and AI algorithms are leveraged to analyze client data to deliver customized services and solutions that align with specific business requirements and objectives.

- Continuous Innovation: Introduction of new software tools, cloud-based services, or cybersecurity measures to address emerging threats and opportunities in the digital landscape.

- Cost-Effective Solutions: Like UBI’s micro coverage elements for cost savings, IT service providers optimize technology investments, streamline processes, and offer scalable solutions to minimize expenses for clients.

How GenAI can help?

GenAI plays a crucial role in advancing Usage-Based Insurance (UBI) by revolutionizing the analysis of real-time driving data. Utilizing sophisticated algorithms, GenAI processes vast amounts of driving data to provide insurers with precise insights into individual behaviors, enabling accurate risk assessment and predictive modeling for proactive coverage adjustments.

Additionally, GenAI generates personalized recommendations for policyholders, aids in fraud detection, and improves customer experience through advanced virtual assistants and chatbots. These capabilities significantly enhance the effectiveness and efficiency of UBI, paving the way for a more personalized and equitable insurance landscape.

Happiest Minds solution:

At Happiest Minds, our commitment lies in revolutionizing the insurance industry with cutting-edge solutions designed to enhance efficiency, customer experience, and profitability. Leveraging our expertise in digital transformation and IT consulting, we offer a comprehensive range of innovative insurance solutions.

From streamlining claim processing with Straight Through Claim Processing to detecting fraud using Generative AI, our offerings cover every aspect of insurance operations. Additionally, our Policy Chatbot, Intelligent Test Engine, Embedded Insurance, and Risk Assessment in Underwriting solutions empower insurers to stay ahead in a rapidly evolving landscape.

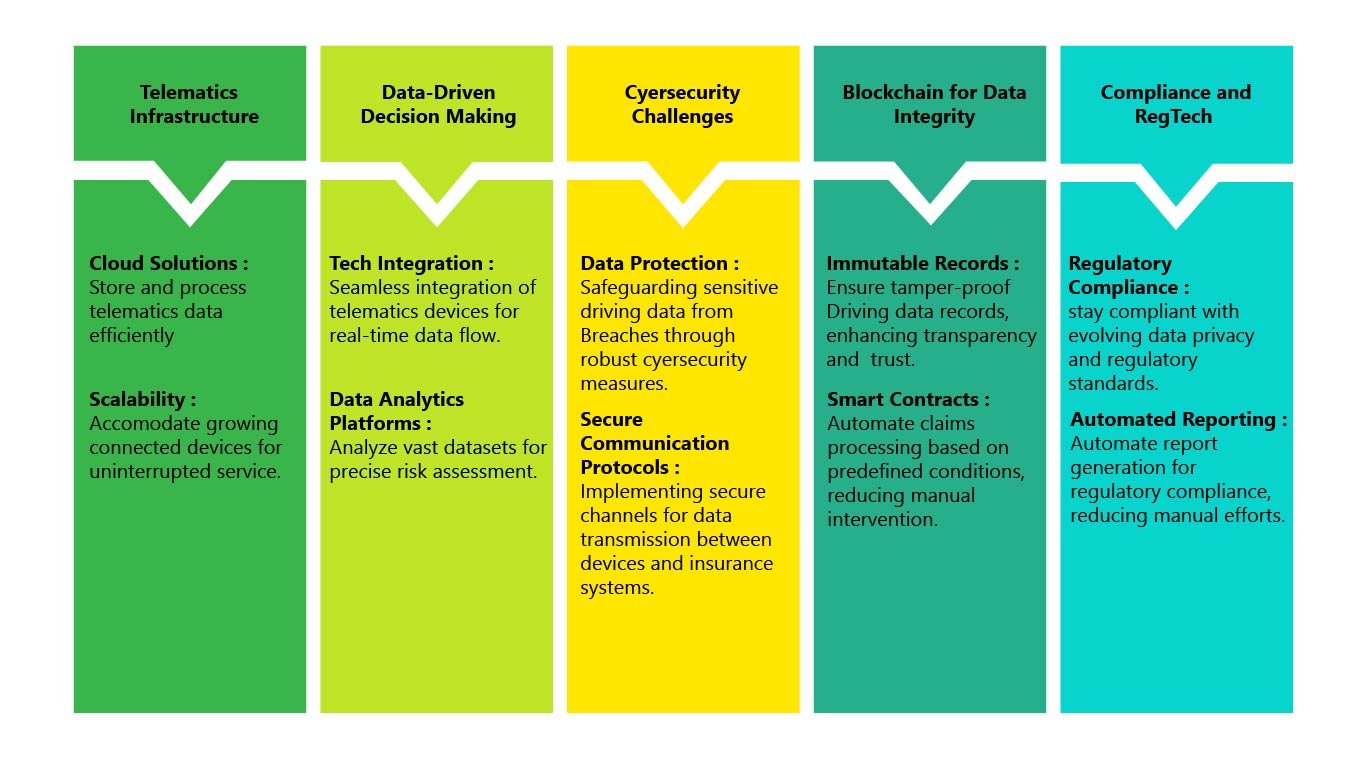

With a focus on infrastructure, security, Internet of Things, next-gen technologies like blockchain, and a deep understanding of the insurance domain, Happiest Minds is committed to driving success for our clients in the insurance sector.

Get in touch with a Happiest Minds BFSI specialist today to understand Insurance technologies solutions and offerings.

is an Insurance Business Analyst possessing in-depth knowledge of property and casualty insurance, backed by over two years of hands-on experience in data gathering, analysis, and research. Demonstrated proficiency extends to conducting market analyses and harnessing emerging technologies such as Generative AI to enhance insurance operations, formulate strategic frameworks, and innovate insurance solutions.