It’s no secret that lending is growing in popularity. The United States Lending Market size is estimated at USD 457.29 billion in 2024, and is expected to reach USD 801.25 billion by 2029, growing at a CAGR of 11.87% during the forecast period (2024-2029). We can only assume this number will continue to rise as the Gen Z population is coming of age and looking for solutions and guidance to improve their financial wellbeing. Gen Z, Millennials, along with traditional bankers are seeking lending options that are most convenient, which often means digital, flexible, and seamless. And with so many loan options available, it’s important that banks and credit unions keep their eye on the latest trends, so they can optimize their lending process and close the customer first.

In the dynamic landscape of financial services, lending is undergoing rapid transformation, driven by technological advancements, changing consumer behavior, and evolving regulatory environments. As we look ahead to 2024, several key trends are shaping the future of lending, revolutionizing how individuals and businesses access capital.

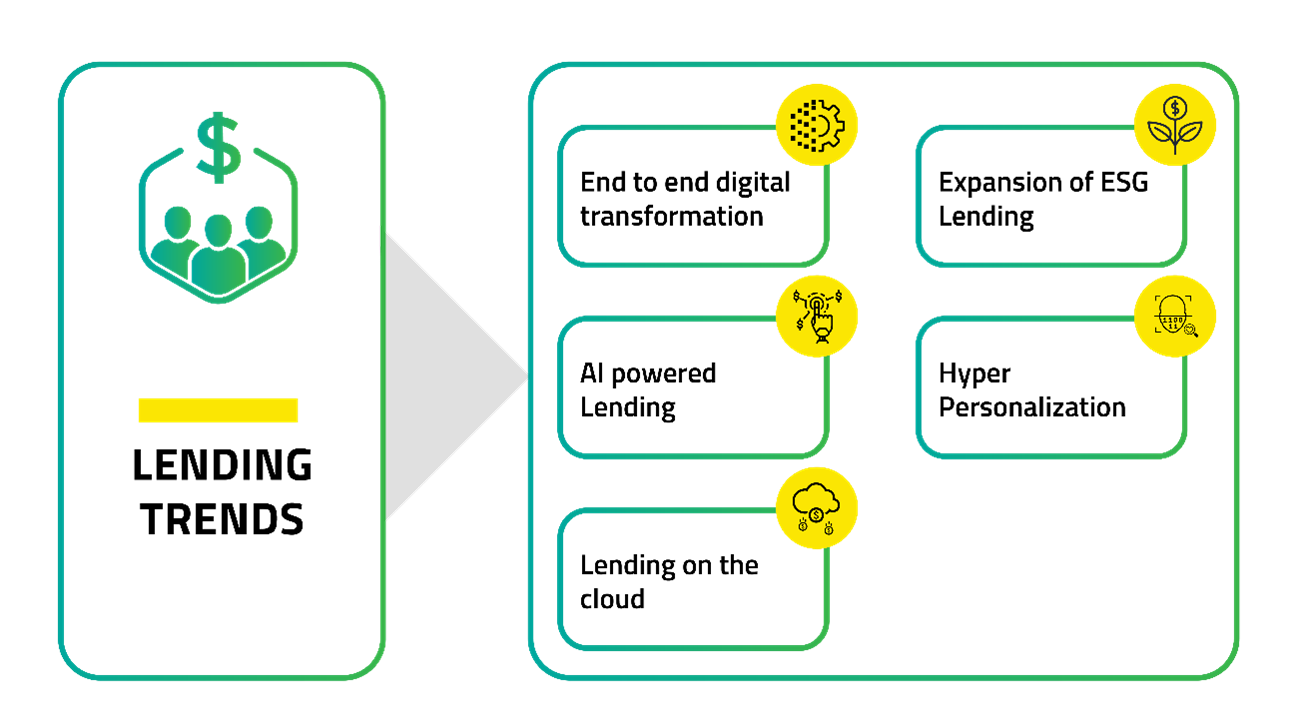

Let’s take a look at few lending trends to keep in mind as you consider how to optimize your loan origination and servicing process.

End-to-end digital transformation

When looking for a loan, one thing that is on the top of every borrower’s mind is the amount of time it will take to complete an application as well as how long it will take to receive a decision. The borrower is focused on the need for the funds, and one searches away from finding numerous other financial institutions with which to apply. Consumers, especially those of the tech-savvy generations, are certainly not interested in driving up to their local branch (assuming there even is one) to fill out paperwork and find documents, or to wait for days for an approval.

Automating the entire loan lifecycle will not only decrease the manual labor for the lender but improve the lending experience for the borrower. Something as simple as using a CRM or system of record to prefill known data or enabling social media shortcuts such as entering LinkedIn credentials to prefill an applicant’s work history can be a huge value add.

Expansion of ESG lending

Environmental, Social, and Governance (ESG) considerations are becoming increasingly important in lending decisions. A growing concern for the environment and other ethical issues is becoming a deciding factor for many consumers when choosing their Financial Institutions. They are ready to reward or penalize organizations based on their efforts or lack thereof to help make the world more sustainable. What began as a concern typically for larger corporations, is now at the forefront of conversations between a bank and potential customer. Now a days lots of Gen Z consumers have stated they are willing to purchase from a company that stands up for environmental and social issues.

In the realm of lending, offering sustainability-linked loans, investing in ESG friendly tech, and being transparent about your organization’s efforts towards issues like carbon emission or gender wage gaps can help you gain a competitive advantage. We anticipate a surge in ESG lending, with lenders offering preferential terms for projects and businesses that demonstrate strong ESG practices, reflecting a growing emphasis on sustainability and social responsibility.

AI powered lending:

Artificial Intelligence is revolutionizing the loan approval process as algorithms and machine learning help FIs look beyond traditional pass and fail guidelines. By leveraging AI-powered lending solutions lenders can target the right customers, provide holistic lending decisions quicker, and improve the customer experience. AI can help to fraud detection during loan origination process and help the lender from potential loss. Artificial intelligence provides countless opportunities for improving customer acquisition and revenue gains. Artificial intelligence also help to analyze the loan portfolio and guide lender to take corrective action for future business.

Hyper-personalization:

In this digital-first era, basic personalization will no longer suffice in financial institutions’ efforts to attract and retain customers. Consumers expect their FI to deliver tailored offers and personalized experiences. With the proliferation of data and advanced analytics, lenders will increasingly focus on hyper-personalization. By leveraging customer data, lenders can tailor loan products and terms to individual borrower needs, offering a more personalized lending experience and improving customer satisfaction. Irrelevant offers coupled with impersonal communication will only lead to low conversion rates and unimpressed customers.

Even if an applicant doesn’t complete their application, FI’s have access to valuable data that they can take advantage of to successfully offer the right product at the right time. Using this data as context to provide hyper-personalized offers will lead to ongoing customer wallet-share and loyalty and increased revenue.

Lending on the cloud

Cloud transitioning is gaining momentum in the banking industry, but it is still in the early stages. The initial motivation to migrate to the cloud was to reduce IT costs, while that is still a valuable benefit, it’s now seen as a way to compete with digital-first competitors and generate revenue. A cloud lending system provides a scalable, flexible, and secure infrastructure that enables you to deliver new services and products to the market quicker while giving you more freedom to innovate and experiment. Cloud lending tools can be used to automate the loan origination process, safely manage documents, and minimize the risk of fraud and theft.

How Happiest Minds Can Help

At Happiest Minds, we are committed to providing innovative solutions that drive business growth and enhance operational efficiency. Happiest Minds, a leading digital transformation and IT consulting company, offers a range of innovative lending solutions designed to enhance efficiency, customer experience, and profitability for financial institutions.

Happiest Minds next-generation loan origination system is an innovative application that has raised the bar in automated solutions. With its powerful decision-making, highly configurable applications, and extensive third-party integrations, Happiest Minds Loan Origination will truly take lending to the next level.

Happiest Minds loan servicing solution system is very flexible and helps lenders to provide customized payment options.

In addition to specific lending solutions, Happiest Minds offers comprehensive digital transformation services to help financial institutions modernize their lending operations. These services include digital strategy consulting, technology implementations, ESG implementation, AI integration and change management, enabling institutions to stay ahead in today’s rapidly evolving lending landscape.

is an accomplished professional with over 16+ years of experience in business analysis, consulting, and product management, specializing in the BFSI industry. Skilled in requirements gathering, gap analysis, feasibility studies, and stakeholder management. Proficient in Agile and Waterfall methodologies, with a proven track record of managing projects and implementing solutions within time and cost parameters. Experienced in Loan/Leasing domain, model development, and 3rd party API integration. Adept at driving process improvements and delivering customer-centric solutions.