What is CBDC?

Central Bank Digital Currency (CBDC) is a digital form of money issued by the country’s central bank that is widely available to the public. A CBDC represents a direct liability of the central bank, not of a commercial bank. There is a raging ongoing debate between advocates and skeptics of CBDC. Skeptics argue that CBDCs may crowd out bank deposits and question their effectiveness in achieving their stated aims, including financial inclusion. On the other hand, advocates of CBDC point out benefits like faster payments and a more secure technological platform, to name a few. But irrespective of which side has gotten it right, the amount of interest and fervor CBDCs have generated merits a comprehensive review.

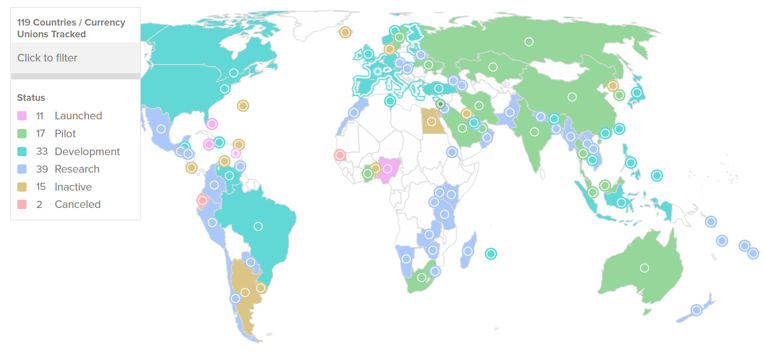

Status of CBDC initiatives around the world

What has prompted an active interest in CBDCs from central banks?

- Fewer cash transactions: The growing trend of digital payments is increasingly marginalizing the role of central banks. This development has prompted central banks to create CBDCs to reassess their role in the monetary system

- Privately issued digital assets: An assessment by the European Central Bank (ECB) has determined that as many as 10 percent of households in six large EU countries owned digital assets. One-fifth of respondents to a McKinsey survey—22 % (India), 20 % (Brazil), and 14 % (US)—reported that they held digital assets as part of their financial portfolios. Central banks have taken cognizance of this rising challenge to fiat currency and aim to introduce CBDCs, thereby avoiding the more damaging consequences of such private digital assets.

- Cost efficiencies: Transitioning from physical currencies to CBDCs entail the apparent benefit of reduction in operational costs involved in physical cash management.

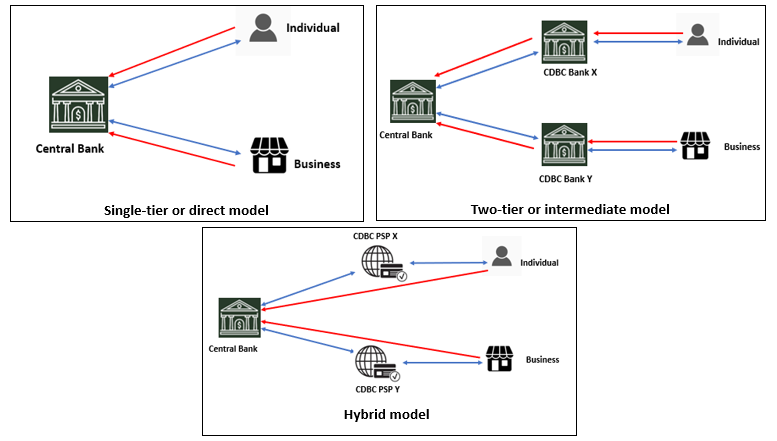

CBDC models

There are three widely accepted models for structuring the CBDC framework

- Single-tier or direct model

- Two-tier or intermediate model

- Hybrid model

![]() – Payment communication channel

– Payment communication channel

![]() – Legal Claim

– Legal Claim

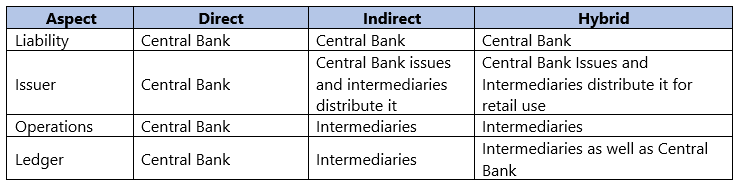

Comparison of the three CBDC models

The key design considerations while issuing CBDCs include

- Type of CBDC to be issued (Wholesale CBDC and/or Retail CBDC) – Retail CBDC is primarily meant to be used by all, viz. private sector, non-financial consumers, and businesses while wholesale CBDC has restricted access and is more suited for use by select financial institutions. While Retail CBDC is a digital version of cash primarily used in retail transactions, wholesale CBDC is intended for the settlement of interbank transfers and related wholesale transactions,

- Models for issuance and management of CBDCs (Direct, Indirect or Hybrid model)

- Form of CBDC (Token-based or Account-based) – CBDC may be ‘token-based’ or ‘account-based’. A token-based CBDC confers ownership rights to the holder at any given point in time. In contrast, an account-based system would require the maintenance of records of balances and transactions of all holders of the CBDC and indicate the ownership of the monetary compensations. In a token-based CBDC structure, the onus is on the person receiving a token to verify the genuineness of ownership, whereas in an account-based CBDC, the identity of an account holder is verified by an intermediary.

- Instrument Design (Remunerated or Non-remunerated) – This attribute determines whether there would be any payment of interest on the CBDC

- Degree of Anonymity – There has been significant debate on the issue of degree. Most central banks and CBCD proponents have agreed that, given the scope for misuse, any CBDC would never match up with fiat currencies in terms of levels of anonymity and privacy currently available.

Currently,, central banks worldwide have the complex task of designing an interoperable CBDC system, allocating roles within the CBDC framework and demarcating the responsibilities of the central bank, the public sector, and the private sector in a CBDC eco-system. The coexistence of a jurisdiction’s incumbent payment systems add to these complexities. However, both would be necessary for the success of a CBDC and would likely evolve with time. Important attributes for the success of a CBDC ecosystem would be its flexibility to scale up in response to future requirements, its interoperability with new and existing systems and arrangements and its resilience to safeguard sovereign policy goals. It is therefore highly important in any CBDC system that the central bank allocate resources judiciously. Therefore, operating a CBDC ecosystem function would be a significant undertaking that needs to be carefully managed to ensure resilience and foster public trust in the CBDC.

Happiest Minds Solution

We at Happiest Minds, with 20+ years of BFS experience, are working on blockchain based DLT solutions that are at the forefront of the technology powering the digital currency revolution. Get in touch with a Happiest Minds BFS specialist today to understand Banking and Financial services technologies solutions and offerings.

is a BFS domain consultant in the Digital Business Services practice at Happiest Minds. He has 14+ years of experience in the banking and financial services industry and has expertise in capital markets, regulatory reporting and compliance and risk management area.