Times have changed! Think of the shopping experience at a brick-and-mortar store. The moment a buyer enters the store, there’s a buyer persona generated in the salesperson’s mind. Based on this persona and a face-to-face conversation, the seller begins recommending products or solutions. It is easy to gauge buyer emotions and act accordingly. However today, stores have gone online and business models have changed. Sellers do not have the luxury of knowing customers by face. Furthermore, the human attention span is believed to be at its lowest ever.

A Microsoft study conducted a few years ago highlights that the average human attention span is only 8 seconds—lesser than that of a goldfish. Hence, online sellers need to react to consumer behavior instantly to grab their attention before they decide to move on to a different seller.

The importance of real-time decision making

Tim has just purchased a car and is looking at getting it insured. Since his first car is insured by insurance provider A, he contacts Insurer A online. Tim receives a lengthy form that he has to fill out. That clearly meant that Insurer A’s existing and new insurance departments were not connected, due to which, despite being an existing customer, Tim had to re-enter his details all over again. Disappointed, he visits Insurer B online. He was an Insurer B customer too a few years ago. Tim enters a few personal details to access quotes, and voila! Insurer B reverts in a minute with a pre-filled form and a message, “Congratulations on your new car purchase. You are just five minutes away from insuring the car.” That’s the power of big data when tapped into in the right manner!

As soon as Tim took the trouble to enter basic personal details, Insurer B realized that he could be a prospect. The insurer retrieved public information available on the Internet and from social media platforms as well data from the company’s older records and presented it to Tim in the pre-filled form requesting him to edit only the details that may have changed now. Tim, very pleased with the customer experience, insured his car through Insurer B within minutes.

What does this mean? Insurer B’s systems were all connected and in sync. Big data and real-time data analytics were leveraged in the right manner at the right time to influence the customer.

A 2018 survey by New Vantage focused on big data and artificial intelligence highlighted that 97.2% of organizations are investing in big data and AI. However, another study pointed out that only 41% of organizations using big data are using it to improve their marketing efforts. A study by Dell revealed that organizations that utilized data grew 50% faster than their peers. These numbers prove that data possession does not mean anything if an enterprise does not use that data wisely.

Small and medium-sized businesses at the crossroads

Digitalization has changed the business arena. Bigger players are introducing multiple variations of their products and solutions for the masses, lowering the barrier to entry. Their offerings are accessible to every consumer, irrespective of economic status, and that is why small and medium-sized enterprises (SMEs) need to act fast!

Big data is an integral part of the new IT environment, and SMEs seem to be struggling to harness the true potential of this technological innovation. They do not know what to do! They do not know how to leverage the insights or take advantage of the change.

According to an article on the World Economic Forum website, by 2025, it is estimated that 463 exabytes of data will be created each day globally. With the availability of such a huge amount of data gathered from individuals, SMEs need to understand that the traditional segmentation-based marketing strategies are becoming obsolete. Every individual is unique and irrespective of age, sex, etc. an individual can have different personas at a different time and location. Personalized marketing, and not persona-based marketing, is the way forward and SMEs need to buckle down, wisely!

The way forward!

Let’s analyze the situation explained earlier in this blog post and understand what enterprises need to do to enhance their returns on big data investments.

- Real-time predictive analytics: Insurer B leveraged actionable insights immediately to influence Tim’s decision. Had the insurer gathered necessary data, analyzed it and reached out to the customer after a few hours or days, Tim’s decision would have been made by then. He would have purchased the car insurance from a different organization. Real-time decision-making was the key factor that led to the impact.

- Access to historical data: Data integration is another key factor that will determine the success of big data initiatives. Sales executives should be able to tap into historical data and information that is already available in the system. Insurer B not only extracted public information about Tim but also pulled out details from their customer records to understand the prospect better and deliver a customized experience.

- Customer delight: Insurer B was able to automate the customer journey to a certain extent by populating the insurance form with available information, and Tim had to only make a few required changes. This made the journey smoother and the quote-to-sale lifecycle significantly shorter.

How Happiest Minds has been helping!

Happiest Minds has been leveraging big data, artificial intelligence (AI) and machine learning (ML) to help businesses stay competitive and relevant. Our Big Data & Analytics Center of Excellence (CoE) has been assisting clients across sectors—retail & consumer packaged goods, banking, healthcare, manufacturing, telecom, and real estate—derive powerful, actionable insights. Here’s a snapshot of how Happiest Minds has been effectively enabling enterprises to succeed in the real world:

Student performance and attrition prediction for an online professional certification course provider: Modeling student behavior to predict: the probability of churn vs probability of completion, time to churn or time to successful completion, topic-wise student performance, etc., helped the client enhance student performance, gain predictive insights for faculty intervention, and derive course curriculum and design insights.

Customer service desk chatbot for a risk services provider and claims administrator: For this client, we developed a customer service desk bot that captured customer requirements and also provided self-service for simple queries, offering time savings for customer and service desk personnel, and decreasing social media resentment.

Image analysis for filtering profanity for a leading media and family entertainment company: A tensor-flow-based deep learning model detected nudity and other awkward postures in pictures so that they could be filtered, bringing down manual effort for image screening.

Consumer data analytics platform for a leading sports media company: A Spark ML-based algorithm analyzed website and mobile app clickstream data to identify users’ affinity toward a sport, team, league, and country, to micro-segment them, and this facilitated better content and ad serving resulting in increased click-through rate.

Property lead generation bot for a leading property development company: An interactive chatbot that understood user preferences and helped with navigation through multiple options before finalizing the one a customer was interested in, enhanced leads significantly.

Visible damage detection for claims processing for a leading mobile insurance provider: A tensor-flow-based deep learning model for identifying damages was able to classify images with 90%+ accuracy, resulting in many claims not requiring manual inspection of uploaded images.

Product recommendation for a leading retail chain: A recommendation engine that takes in clickstream data to identify user preferences and recommends the most appropriate product increased cross-sales by 10-12%.

Anomaly detection on network traffic for a network and application service provider: Our anomaly detection platform based on Spark ML and Spark Streaming identified anomalous happenings without the need to define any rules, increasing awareness of such activities and decreasing time to identify issues.

The power of big data and analytics is limitless and the benefits are real. As you can see above, Happiest Minds has been working with multiple and varied business stakeholders over the last few years, defining problem statements and delivering impact!

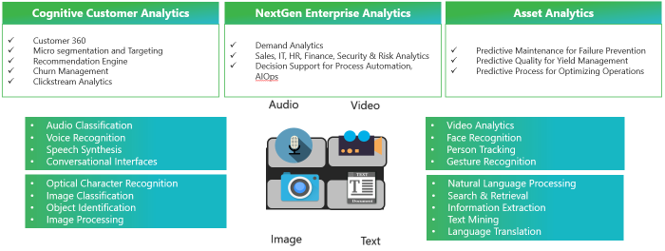

Our Big Data and Analytics CoE Offerings:

Our data science, AI and ML offerings:

Get in touch or click here to know more about how we have been helping enterprises unlock benefits through our analytics offerings.

Manish Mehrotra, Vice President & Sales Head, Digital Business Services at Happiest Minds. He is an experienced growth & digital business transformation leader. He is an evangelist and a technology enthusiast and has counselled a variety of fortune 100 clients on digital strategy and tactics and engagement pipeline management, skills, training & utilization management.